The Economic Watch – January 2015

The Economic Watch

California Economic Forecast

PLANNING RECOMMENDATIONS FOR 2015

by Mark Schniepp

Congratulations

You made it through the holidays and now you’re back at work fully rested and motivated to start off 2015 with a bang. A more profitable year or a higher salary is on the resolution list. Right? Well, hopefully so, because you’ll need additional income to pay off that December credit card statement. The early evidence suggests that our spending was up 8 percent between Black Friday and Christmas this year.

And that should be no surprise because our extra spending this holiday season was simply a manifestation of the economic expansion that was prevalent throughout 2014. Furthermore, you already feel wealthier with the stock market at record highs and the value of your house rising sharply the last two years…..

And this year, collapsing oil prices are giving us additional spending money every time we stop for gas. Remarkably low interest rates are keeping our car and house payments low and extending us cheaper credit opportunities, at least for the next several months.

2015 Planning Tips

The combination of more jobs, faster wage growth, low gasoline prices, and rising wealth will lift consumer confidence to even higher levels in 2015, implying more spending on automobiles, consumer goods, and even real estate. If you’re a vendor of retail goods or services, this could be your best year.

Interest rates keep falling. If you need to refinance, do it now. Conventional mortgage rates are below 4.0 percent again. If you need to buy that commercial building, don’t wait any longer. Occupancy is rising in all major markets, and there are growing pressures on lease rates.

Hold off on the Prius purchase for the moment. Gasoline prices are going to stay relatively low for a while, or at least until oil producers start cutting back some, which they ultimately will this year. And hopefully OPEC won’t be sharply cutting production much either anytime soon.

El Niño conditions have recently been strengthening again and there is at least a 65 percent chance that a higher propensity of rain is likely between now and the spring months. So if you are planning to replace your thirsty lawn with succulents, you might want to wait a few months to see how much it rains this season.

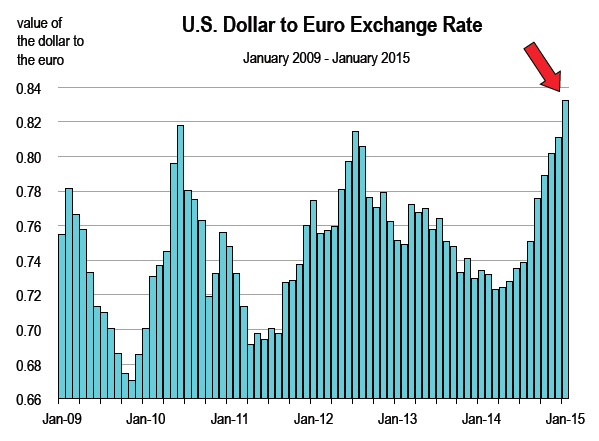

Speaking of strengthening, the dollar has rallied against the other world currencies, especially the Yen, the Euro, and the Canadian dollar. This trend is expected to continue throughout 2015. Imported goods from foreign countries should be cheaper. So plan that vacation to Thailand this year.

If you are a rental property owner or renter, you know how tight the market is right now and you know that rents are rising. This condition is not going to weaken. In fact, the market is likely to tighten further before loosening up. If you’re a renter, be prepared to give yourself plenty of time when searching for housing this year, and also expect three to four percent higher rental rates than last year.

If you’re betting on inflation, don’t. While higher rates of inflation are warranted this year, they’re not likely to rise that much. Wages will be higher and health care costs will continue to rise, along with rents, and possibly food. The cost of TVs, phones, and other electronics is likely to continue falling. And of course, energy prices are lower and are likely to stay that way for much of the year.

Hospitality industry businesses will continue to experience high levels of transient and restaurant demand, from both recreation and business visitors. Make your summer vacation plans early this year because the best deals and locations will book up early.

More housing development should also be forthcoming this year. If you’re in the market for a new home, this may be your year. Or certainly, by 2016. Normally I’d suggest that you act quickly in view of the impending rise in mortgage rates expected this year. However, there’s still not much inventory yet, and credit conditions should ease further, in terms of down payments and FICO scores. Consequently, there may be greater opportunities to qualify for a mortgage loan as the year progresses. And credit conditions should further ease in 2016.